Most people go through fairly predictable stages in life: Graduation, marriage, raising a family and retirement. But rarely does life fall into place perfectly, as planned.

A single accident can change the course of a person’s life. One small misstep or simply bad timing could sometimes be life-changing – even fatal. The human body is more fragile than it seems.

We are often blindsided by things that we are unprepared for, simply because we choose to believe in the “it will never happen to me” fallacy.

But the truth is, tragedy can strike anyone, anytime and anywhere.

What if you are the family’s sole breadwinner? Have you ever thought about what might happen to your loved ones when you lose your ability to work and care for them?

What if illness strikes not you, but someone in your family? Do you have the finances to provide the best care for him or her?

Ultimately, it is impossible to predict when misfortune will strike, so the best remedy is simply to be prepared. Having adequate insurance coverage for yourself and the ones you love will help you tide over life crises.

Are Singaporeans prepared enough?

The Life Insurance Association’s 2017 Protection Gap Study found that economically active individuals in Singapore have an approximate 40 percent mortality and critical illness gap totaling approximately S$893 billion.

A more recent survey of over 500 people carried out by China Taiping Insurance (Singapore) re-leased in March this year drew a similar conclusion: The insurance coverage of most Singaporeans is less than ideal.

Almost one in four Singaporeans lacks either life or general insurance, leaving critical gaps in their coverage. One in every two Singaporeans lacks critical illness insurance, while almost one in three Singaporeans does not have health and hospitalisation insurance, or life protection insurance — some of the most crucial policies in one’s portfolio.

This might be explained by another finding from the same survey by China Taiping Insurance (Singapore) which revealed that more than half of the respondents felt they did not have sufficient knowledge of the insurance offerings available in the market.

With so many different insurance products in the market, and without knowing what each of them can do for your family, the process of picking the right insurance policy for yourself and your loved ones can seem daunting.

But it is worth making the effort to do so before it is too late — because there is no telling what life will throw at you. Ultimately, insurance isn’t just about protection; it is an expression of love for your loved ones.

China Taiping Insurance (Singapore) offers both life and general insurance, ranging from life protection, retirement, savings, motor insurance and travel insurance, to insurance for domestic helpers.

A gift across generations

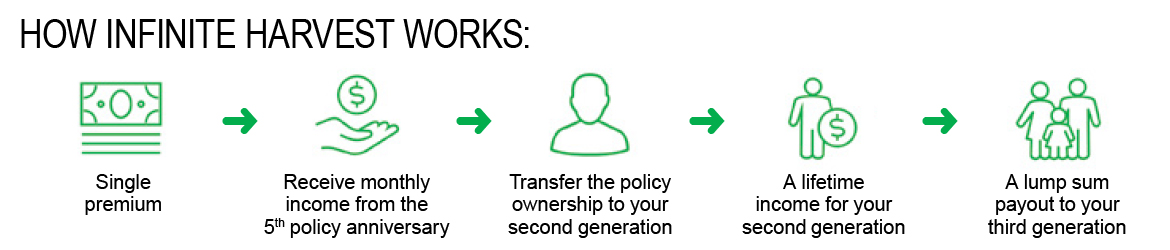

A life insurance plan like China Taiping Insurance (Singapore)’s Infinite Harvest (III) (see below) can be a source of continuous monthly income for the second generation. When they turn 18, the policy can be transferred to their name, ensuring that they can be supported for life, even when you can’t physically be there for them.

And when the second generation eventually passes on, the third generation will receive a lump sum payout — ensuring your love will continue across generations.

So whether it is as a safety net for unforeseen circumstances, or to relieve financial burdens, insurance — at its core — is about caring for those who matter the most to you.