A dedicated marathon runner, health conscious and practical by nature, Mr. Mak Kwok Fai owes his amazing recovery both to his physical fitness and his wise investments in insurance.

Tragedy can strike at any moment, and how well you cope depends on how much you have prepared for the worst. Kwok Fai’s personal tragedy is a lesson in good judgment that all of us can learn from.

Surviving Stroke

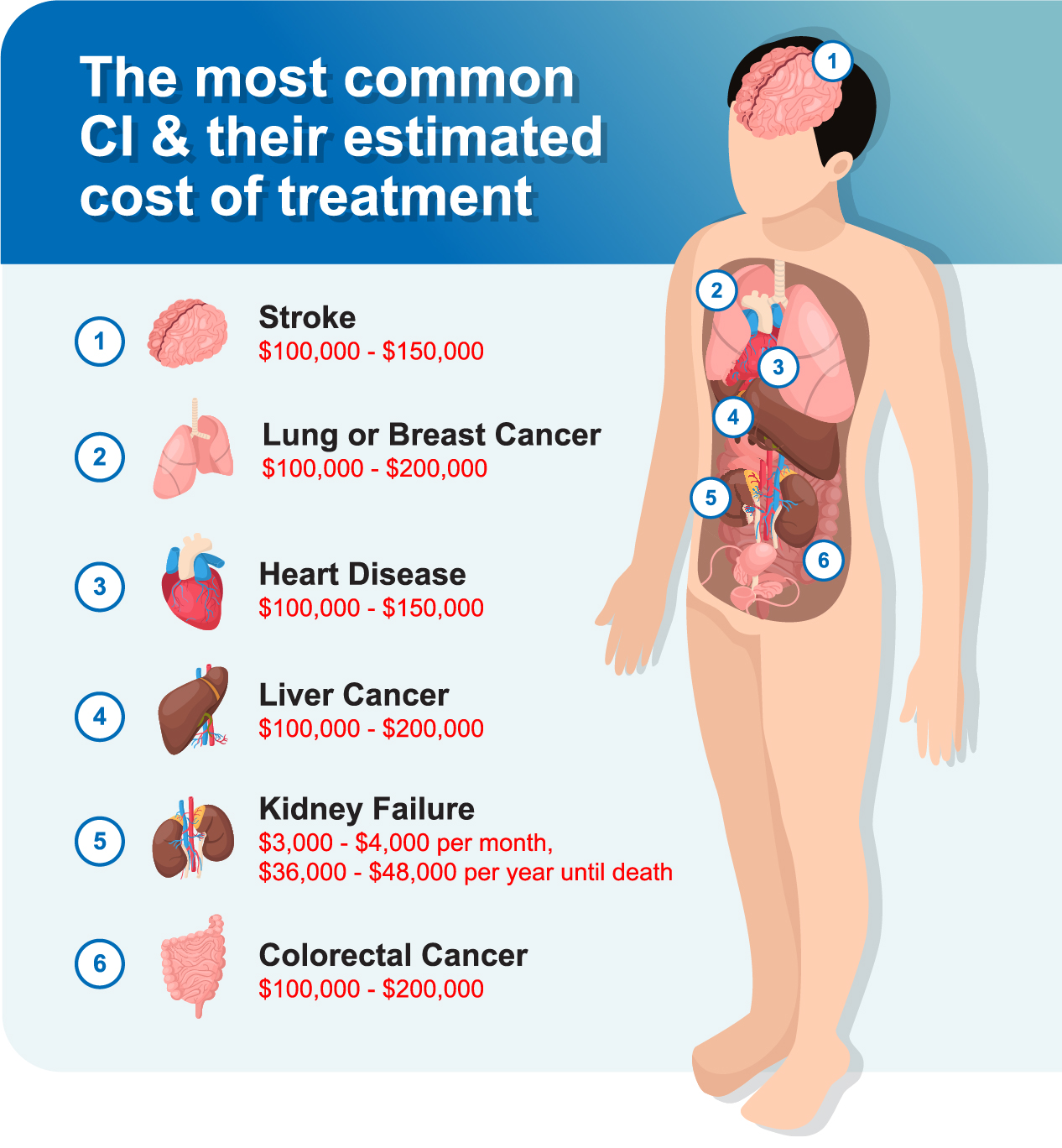

A Life Insurance actuary by profession, Kwok Fai knew the importance of being prepared for any eventuality. He took good care of himself and stayed healthy and fit; and he invested in Life Insurance policies with Critical Illnesses (CI) coverage. At the young age of 29, the last thing he expected was to suffer from a hemorrhagic stroke and to undergo emergency brain surgery.

“I was young and fit, and I had so many personal and career goals. I was chasing after a promotion; I enjoyed the occasional drinks after work with friends. I was in a meeting one day when I felt a severe pain in my head, followed by dizziness. I managed to text a colleague before I lost consciousness in the restroom. When I woke up, I had already had my brain surgery and the life that I used to enjoy and had planned for changed in the blink of an eye.”

Kwok Fai spent three months at the Singapore General Hospital. When he finally went home, he still suffered from partial paralysis that affected his speech, motor skills and ability to stand and walk.

Road to Recovery

Kwok Fai’s frightening near-death experience and his emergency treatment were just the first of the many difficult challenges he and his family had to deal with.

After he was discharged from the hospital, he had to seek various post-hospitalisation therapies such as physiotherapy, occupational and speech therapy. He needed to use walking aids and deploy special modifications at home to help him move around. His road to recovery would have been a huge financial burden on Kwok Fai and his family.

Fortunately, he had a safety net in place - his Life Insurance.

When Preparedness is Rewarded

Kwok Fai’s profession has given him a better appreciation of the value of being prepared for whatever difficulties life may throw at him. His wise investment in a Whole Life plan with Death, Disability and CI coverages, together with a Term plan which included CI coverage - cushioned him financially when he needed it the most.

For Kwok Fai, his insurance policies were the best investments he had ever made. The total claim payout he received from both plans amounted to S$300,000. This was 15 times more than the total premiums he had paid over the years.

The insurance payout helped lighten the financial burden of hospitalisation and post-treatment expenses and the temporary loss of income. Perhaps even more importantly, Kwok Fai and his family were able to afford the best treatments possible, including alternative therapies and hiring a domestic helper, without worrying about finances.

Kwok Fai has since completely recovered and has gone back to marathon running. The stroke he suffered means he is no longer insurable, so it has become more important than ever that he maintains optimal fitness and health. His new lease on life has also inspired him to do volunteer work and appreciate every waking moment.

Are You and Your Family Sufficiently Covered for Critical Illnesses

Based on studies by Life Insurance Association (LIA), an average working Singaporean requires around S$316,0001 of CI protection value; however, most are only covered for 20%2 of their CI needs.

Kwok Fai’s experience should serve as a reminder to all of us that we should take the necessary steps to protect ourselves and our loved ones against unexpected threats to our health and livelihood. Investing in protection plans is a win-win decision and a practice in sound judgment, no matter what obstacles we encounter.

Customise Your CI Coverages with China Taiping Insurance Singapore

i-Secure protects yourself and your loved ones with whole life coverage against Death, Terminal Illness, Total and Permanent Disability, as well as 161 CI.

- Up to 4x Guaranteed Benefit to either age 71 or 86, extendable for life.

- Flexible premium payment terms of 5, 10, 15, 20 or 25 years.

- Enjoy cash values and bonuses throughout the policy term.

Find out more about i-Secure: https://bit.ly/isecuread

Source:

1 https://www.businesstimes.com.sg/banking-finance/working-adults-in-spore-have-inadequate-cover-if-critical-illness-strikes-study

2 https://www.lia.org.sg/media/1334/press-release.pdf

Important Notes:

Protected up to specified limits by SDIC. This advertisement has not been reviewed by the Monetary Authority of Singapore. You should seek advice from a financial adviser representative before making a commitment to purchase the plan. In the event that you choose not to seek advice from a financial adviser, you should consider carefully whether this plan is suitable for you. This marketing material is not a contract of insurance and is not intended as an offer or recommendation to purchase the plan. Information is correct as of 26 June 2020.